Table of Contents

In an era of heightened environmental awareness, businesses face the challenge of authentically demonstrating their commitment to sustainability. However, the rise of greenwashing poses a significant threat, with companies attempting to exaggerate or falsely promote their environmental efforts. This not only erodes consumer trust but also hampers progress toward a truly sustainable future. In this blog, we will learn about :

- Impact of greenwashing on companies

- Key steps for businesses to combat it

- Evolving landscape of greenwashing regulations

What is Greenwashing Regulation

Greenwashing occurs when companies engage in deceptive tactics, making exaggerated or false assertions about their commitment to environmental responsibility. Recognizing the potential harm this can inflict on consumers, the environment, and legitimate efforts toward sustainability, governments and regulatory agencies have implemented frameworks to hold companies accountable for their environmental claims.

Greenwashing regulation aims to curb the misleading claims made by companies regarding their environmental initiatives, ensuring that businesses adhere to transparent and accurate communication regarding their sustainability efforts. These regulations provide guidelines and standards that companies must follow when making statements about their environmental practices. They seek to foster a culture of authenticity and accountability in corporate sustainability, safeguarding consumers from deceptive marketing practices and promoting genuine efforts to reduce environmental impact.

The Impact of Greenwashing on Companies

Greenwashing can have severe consequences for businesses, extending beyond reputational damage to legal repercussions, increased compliance costs, and potential competitive disadvantages. To mitigate these risks, companies must proactively embrace genuine sustainability practices and align with stringent greenwashing regulations.

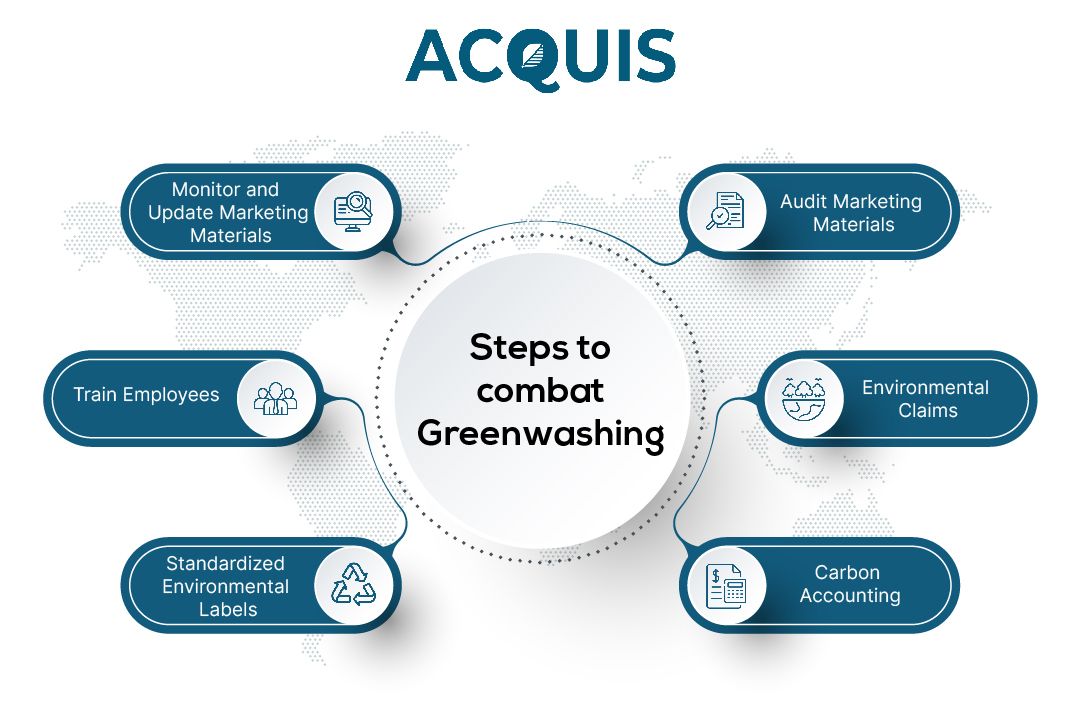

Key Steps for Companies to Combat Greenwashing:

- Review and Audit Marketing Materials: Conducting a meticulous review of all marketing materials and environmental claims ensures accuracy and compliance with regulations. Scrutinizing language, imagery, and assertions related to sustainability is crucial.

- Substantiate Environmental Claims: Providing concrete evidence to support environmental claims from credible sources, such as scientific studies or third-party certifications, is essential for building consumer trust and meeting regulatory requirements.

- Rigorous Carbon Accounting: Implementing robust carbon accounting practices, especially for scope 3 emissions, and supporting claims with verifiable data underscores a commitment to the accurate representation of environmental impact.

- Implement Standardized Environmental Labels: Adopting standardized environmental labels, such as the EU Ecolabel, provides consumers with reliable information about a product's environmental performance and demonstrates compliance with regulations.

- Train Employees on Greenwashing and Regulations: Comprehensive training for employees ensures a thorough understanding of the risks associated with greenwashing and equips them to identify compliance issues. This includes educating staff on sustainability claims and regulatory nuances.

- Continuously Monitor and Update Marketing Materials: Regularly reviewing and updating marketing materials is essential to stay in line with evolving sustainability research and regulatory changes. Keeping abreast of new developments helps companies maintain accurate and relevant claims.

Greenwashing Regulations in Different Regions:

Greenwashing Regulation in Europe:

- Sustainable Finance Disclosure Regulation (SFDR): Addresses ambiguity around sustainable product labels, categorizing funds into Articles 6, 8, and 9, each with different transparency requirements.

- EU Taxonomy: Outlines six environmental objectives, providing clear definitions to help asset managers design credible green products aligning with approved standards.

- Corporate Sustainability Directive (CSRD): Strengthens reporting and disclosure requirements, introducing mandatory third-party assurance on sustainability claims and quantifying environmental reporting.

- Sustainability Disclosure Requirements (SDR): Introduced by the UK’s Financial Conduct Authority (FCA), ensures sustainability-related claims are “clear, fair, and not misleading.”

Greenwashing Regulation in North America:

- SEC Names Rule: Amended in 2023 to ensure investment funds with ESG or thematic names align at least 80 % of holdings with their stated focus. The SEC extended compliance deadlines in March 2025 large fund groups must comply by June 11 2026, smaller funds by December 11 2026..

- Climate and ESG Enforcement Task Force: Active since 2021, the SEC’s task force continues to pursue misrepresentation cases. In 2025, it expanded its mandate to cover green-bond disclosures and ESG rating transparency, signalling stronger anti-greenwashing enforcement.

Greenwashing Regulation in Asia Pacific:

- Singapore (GLS): Continues under the Singapore Environment Council’s oversight, with updated 2025 criteria covering packaging waste and lifecycle emissions.

- Malaysia (TCFD): The Securities Commission released its TCFD Implementation Guide (2024) for listed companies, and updates in 2025 extend it to financial institutions.

- Japan: The Financial Services Agency finalized its ESG fund labeling rules in mid-2025, restricting use of “ESG” to funds where ESG factors are a “material consideration.”

- Hong Kong (SFC): Enforced new ESG fund disclosure requirements effective July 1 2024, with periodic compliance reviews now underway.

- China: As of 2025, national authorities are drafting a unified Green Finance Taxonomy 2.0, expanding coverage to 200+ industries; enforcement is still limited.

- India: The Securities and Exchange Board of India (SEBI) updated its Green Debt Securities Regulations (2024), defining explicit “greenwashing” criteria and enhanced disclosure rules for issuers.

The Impact of Greenwashing Regulations on Companies:

- Reputational Damage: Engaging in greenwashing can inflict severe reputational harm, leading to a loss of consumer trust and potentially impacting a company's bottom line.

- Legal Consequences: Non-compliance with greenwashing regulations can result in legal actions, including fines, penalties, or even the suspension of business operations.

- Increased Compliance Costs: Adhering to greenwashing regulations may necessitate additional investments in resources, such as legal and sustainability experts or third-party audits of environmental claims.

- Competitive Disadvantage: Companies failing to comply with greenwashing regulations may find themselves at a competitive disadvantage, as consumers increasingly prioritize environmentally responsible products and services.

How to address Greenwashing

Governments globally are combating greenwashing through taxonomies, labeling rules, and legal actions. Asset managers must stay informed about specific anti-greenwashing regulations, be transparent about investment strategies, use reliable ESG data sources, seek third-party verification, establish internal compliance procedures, and maintain thorough documentation.

Conclusion: Strengthening anti-greenwashing regulations remains central to restoring consumer trust and credibility in sustainability reporting. As of 2025, enforcement bodies from the EU to Asia are tightening audits and disclosure rules, while the U.S. SEC continues to expand ESG oversight. Companies that embrace data-verified claims, independent assurance, and transparent lifecycle metrics will not only stay compliant but position themselves as global leaders in sustainable business integrity.